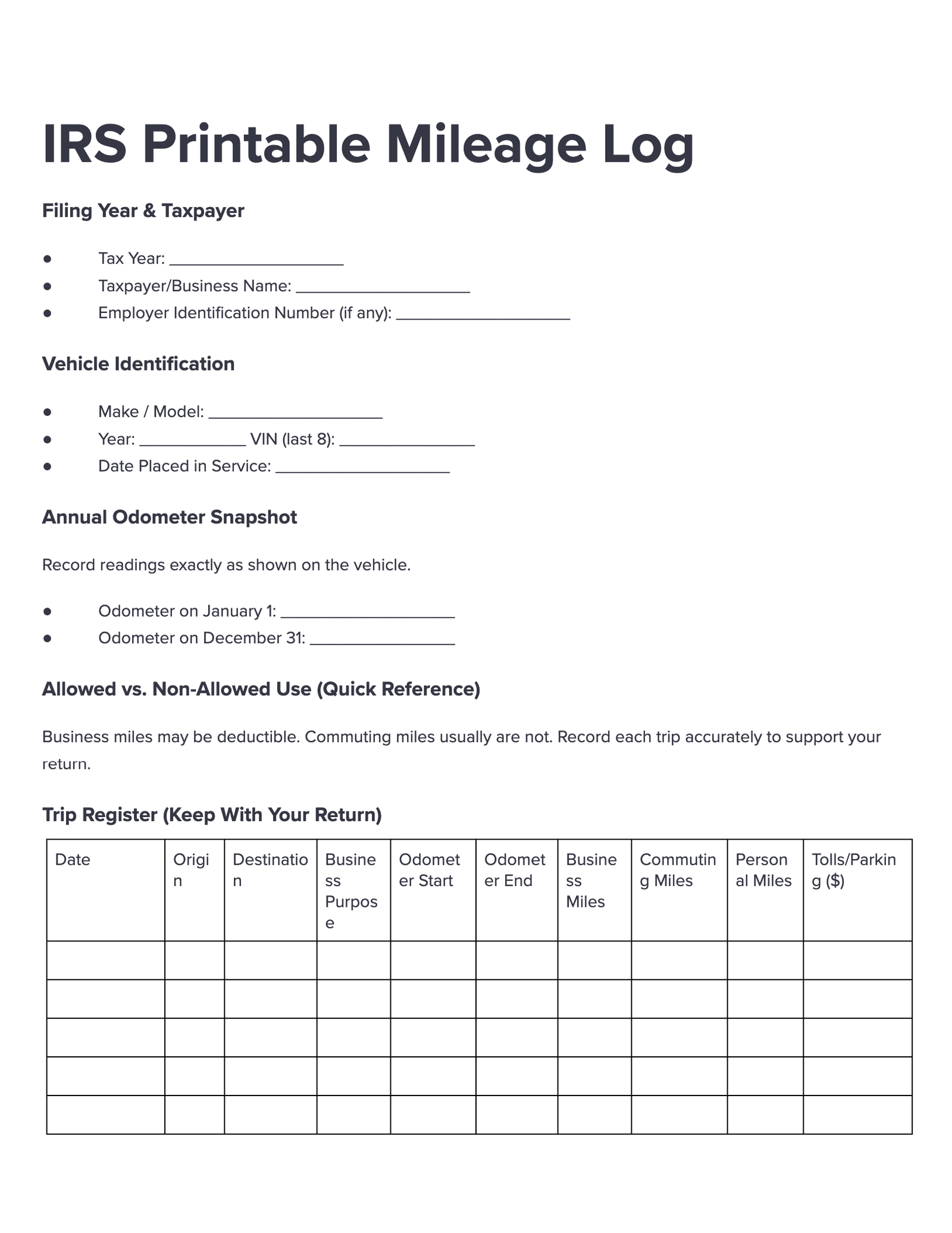

A mileage log is a detailed monthly and yearly record of vehicle travel and your drives. These logs are primarily used for tax deductions and expense management. It is helpful to clearly track both business and personal trips to calculate and deduct certain types of mileage on your taxes and is needed for IRS audits. You can find different types of mileage log template in word, pdf, google docs formats to download at Docsi and edit them as per the required format to maintain your mileage log.

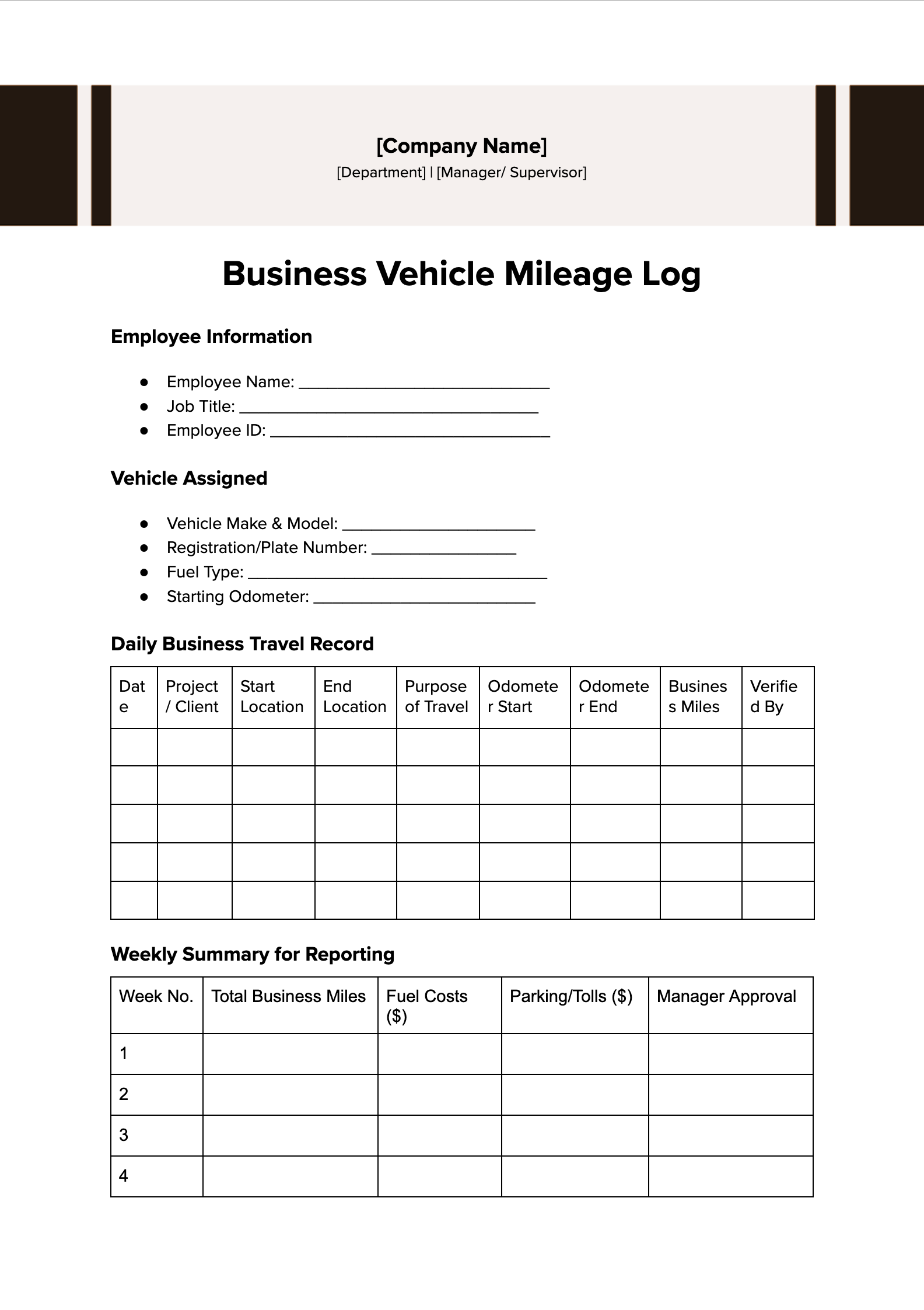

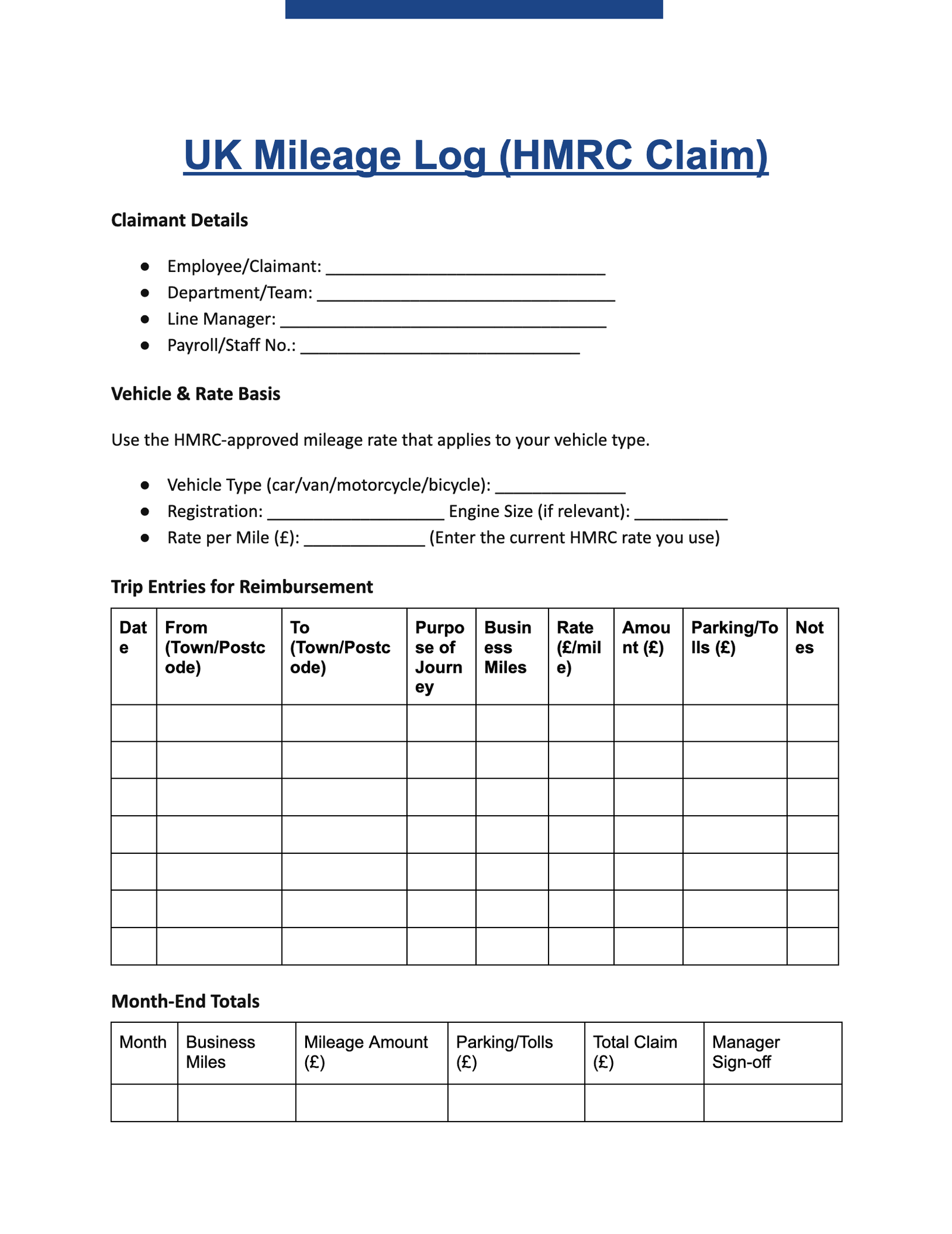

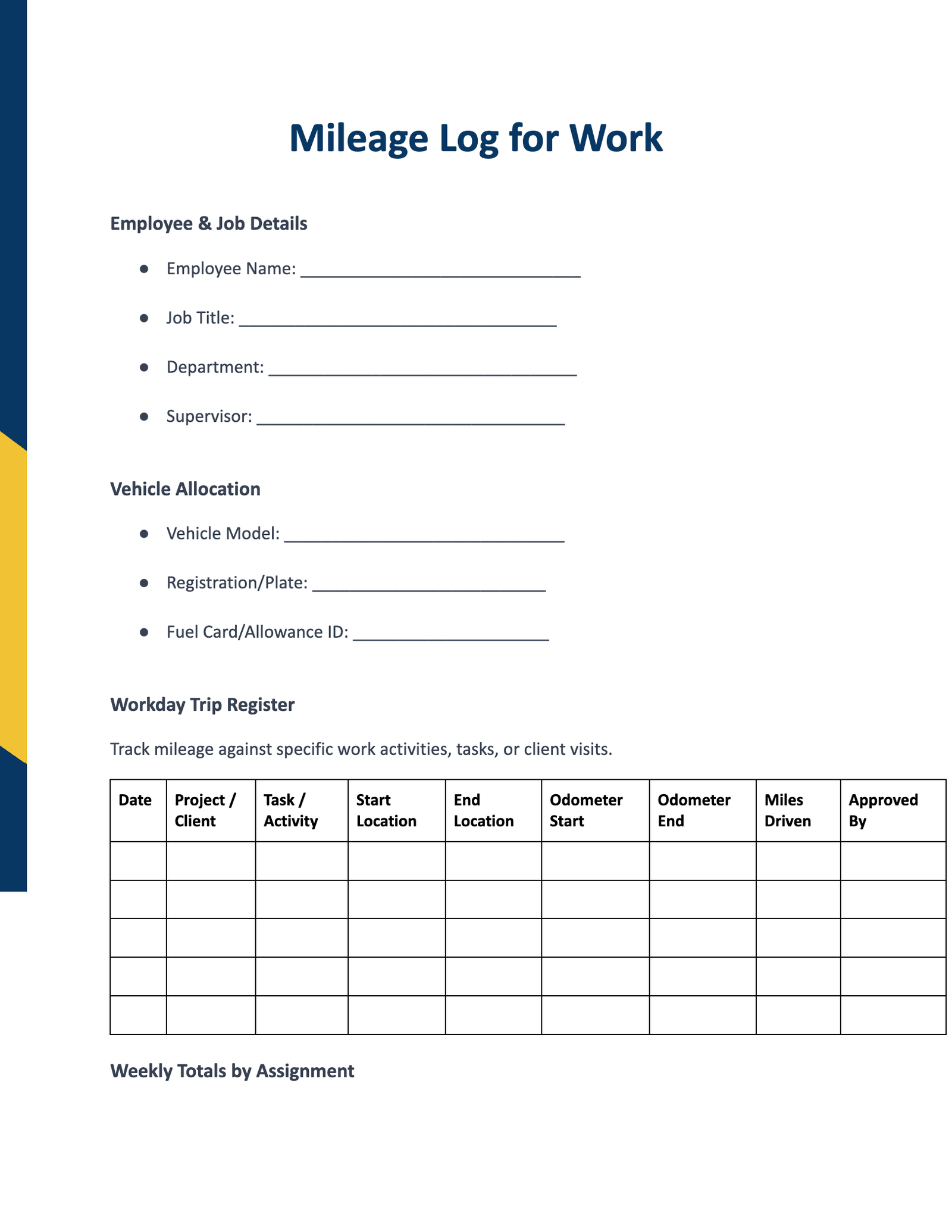

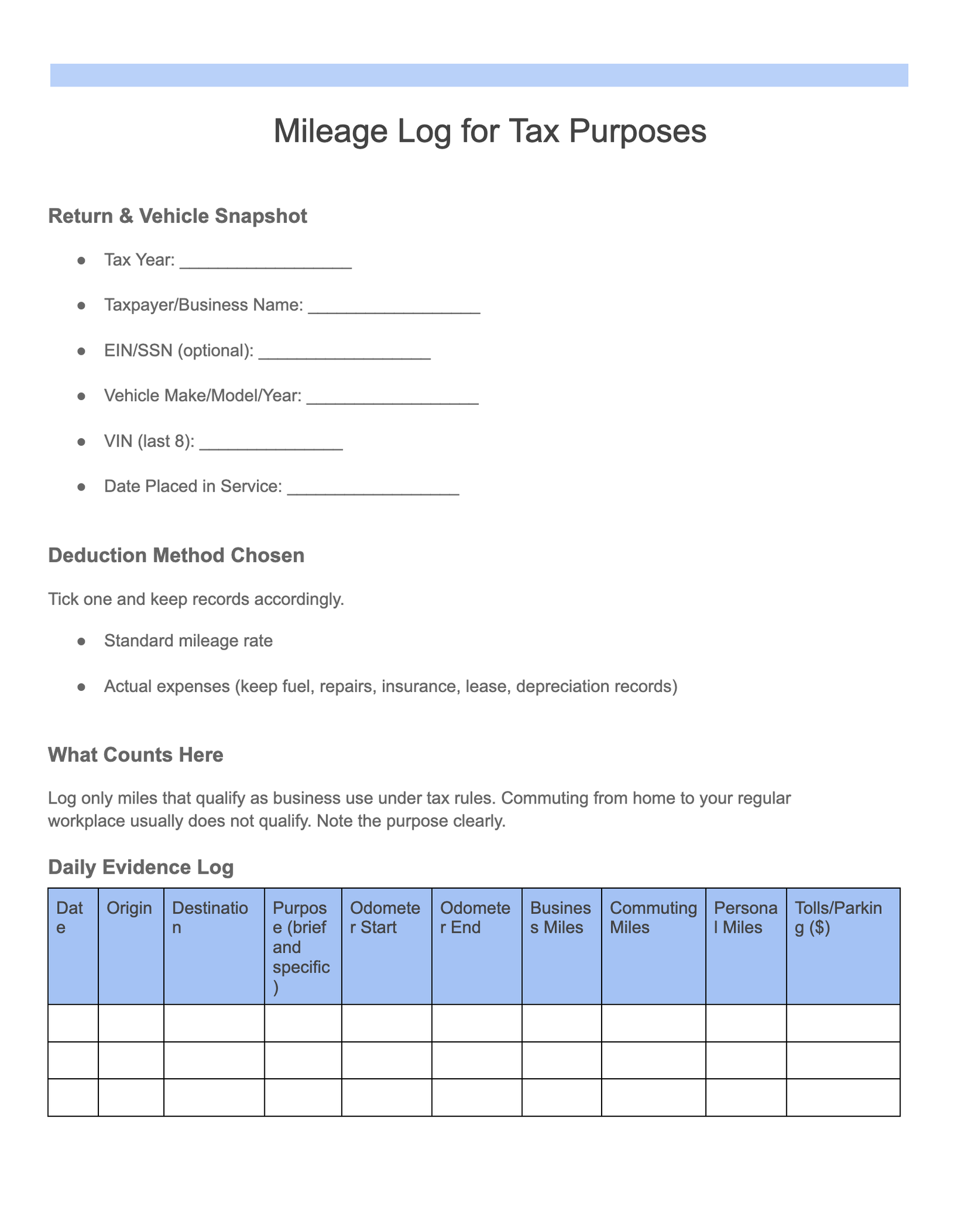

Mileage Log Templates to Download in MS Word, Google Docs

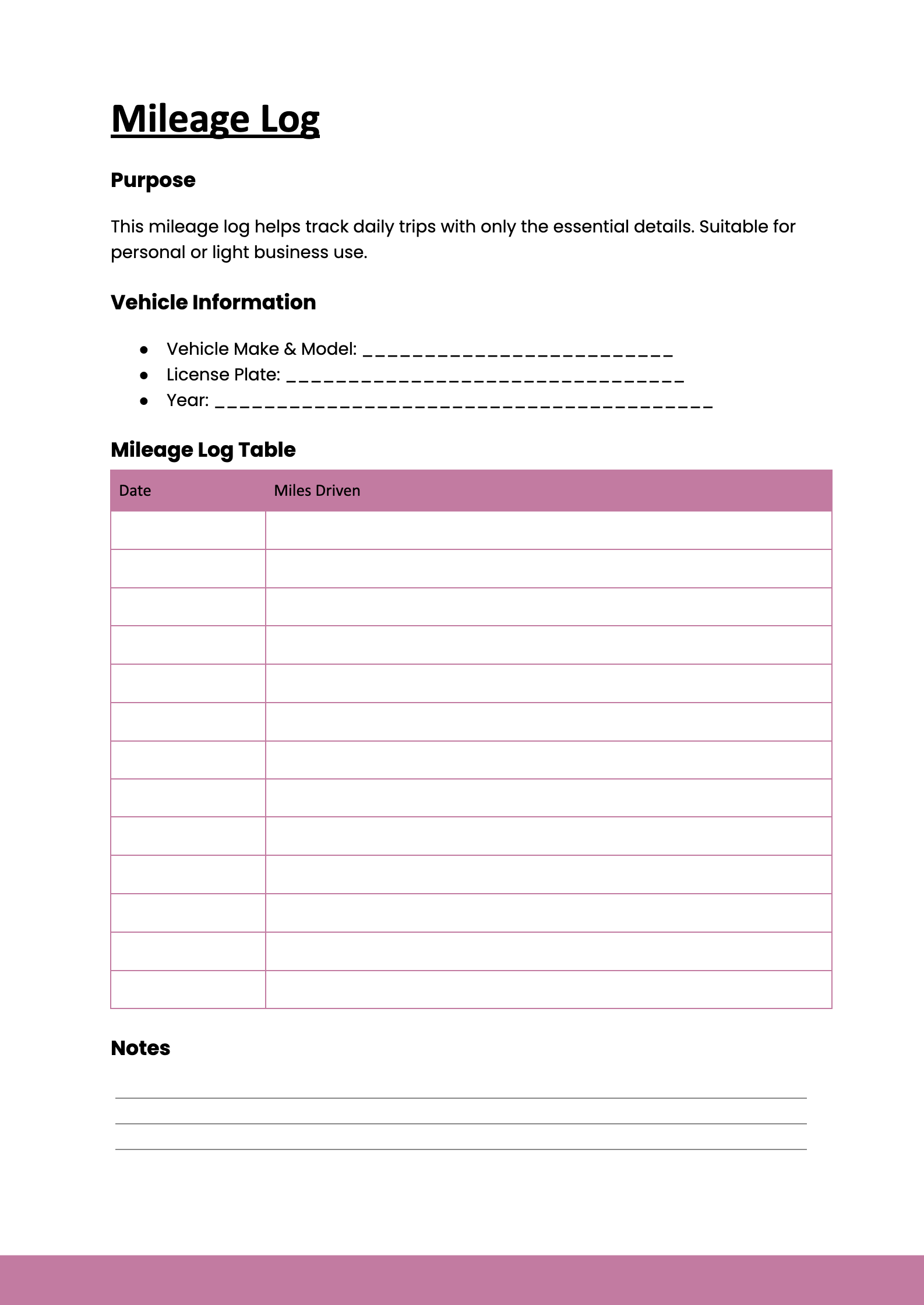

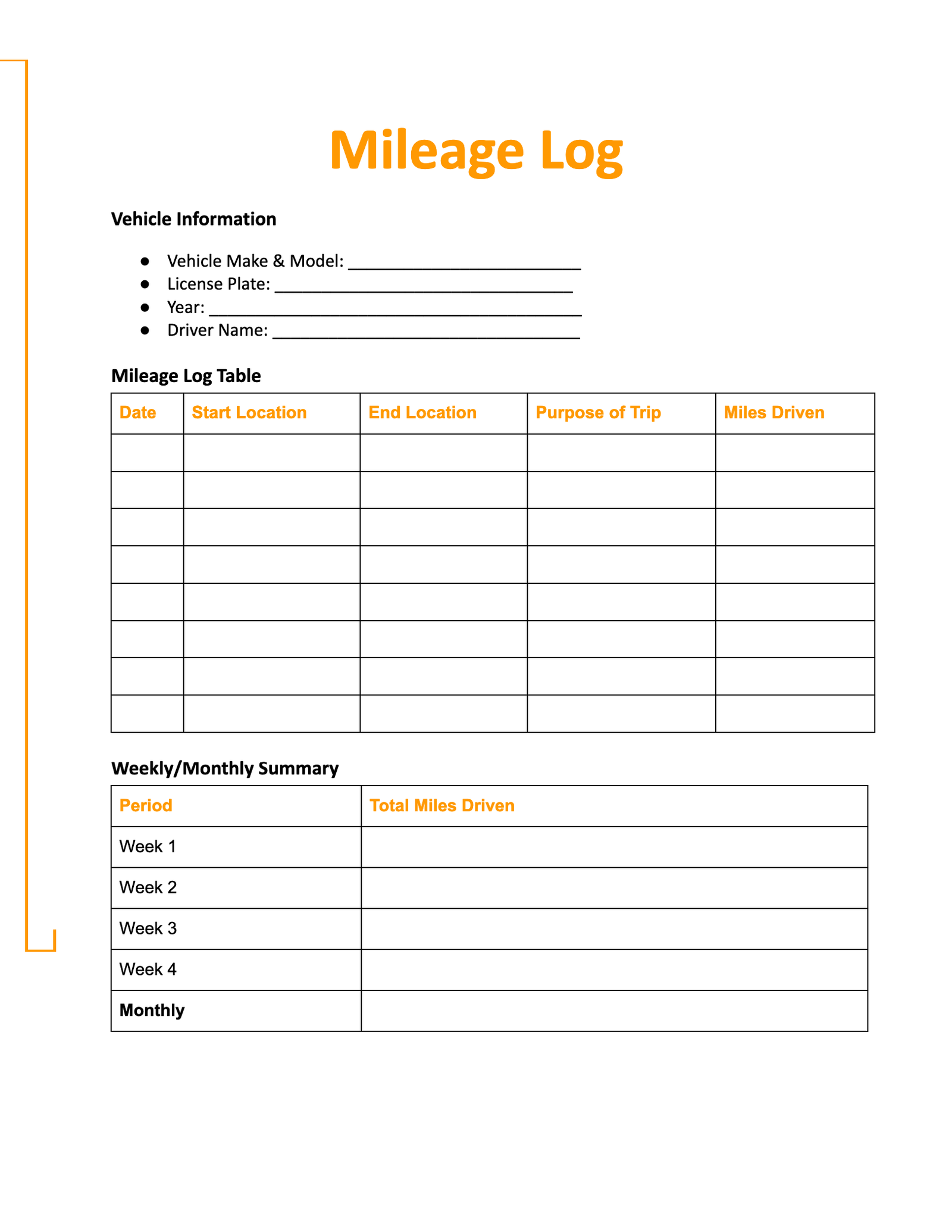

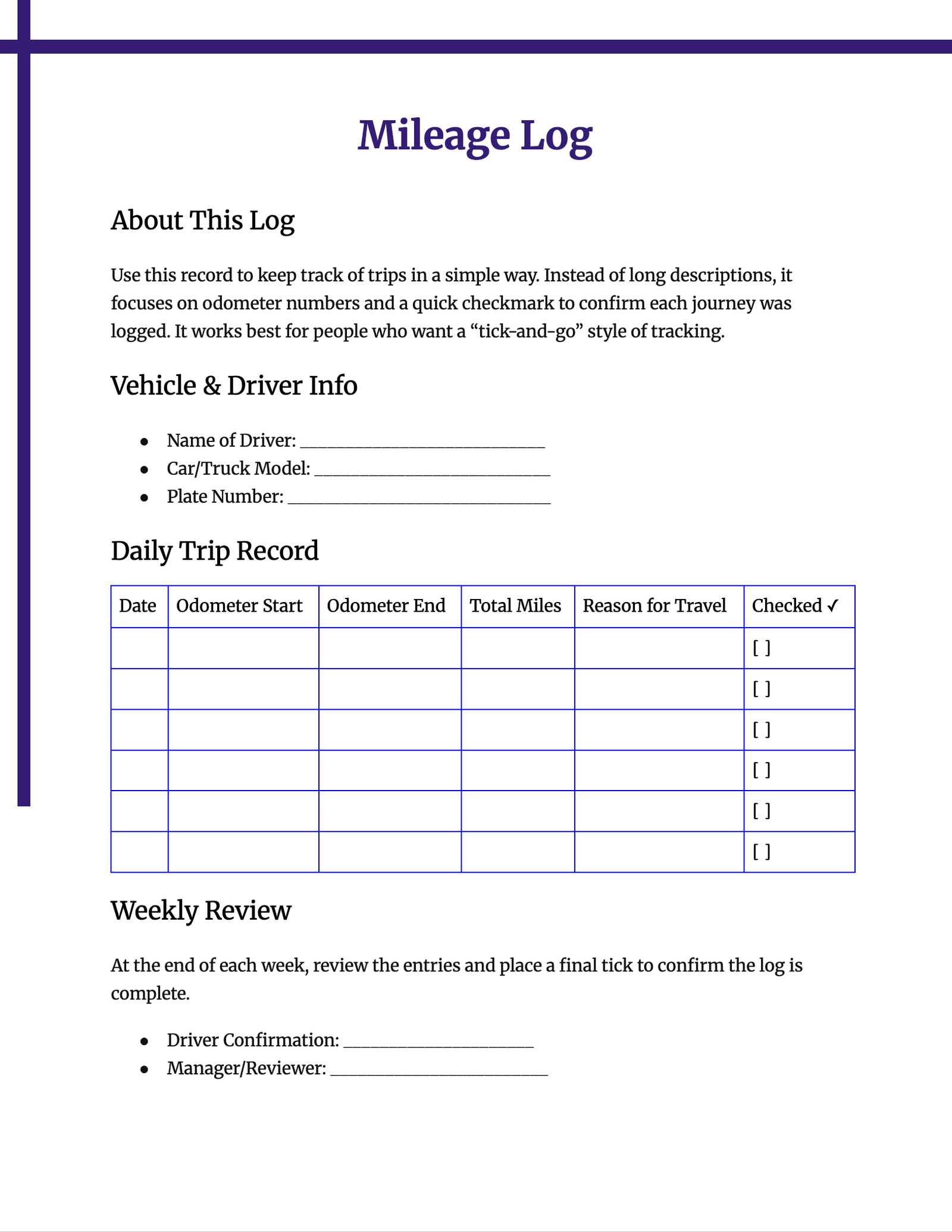

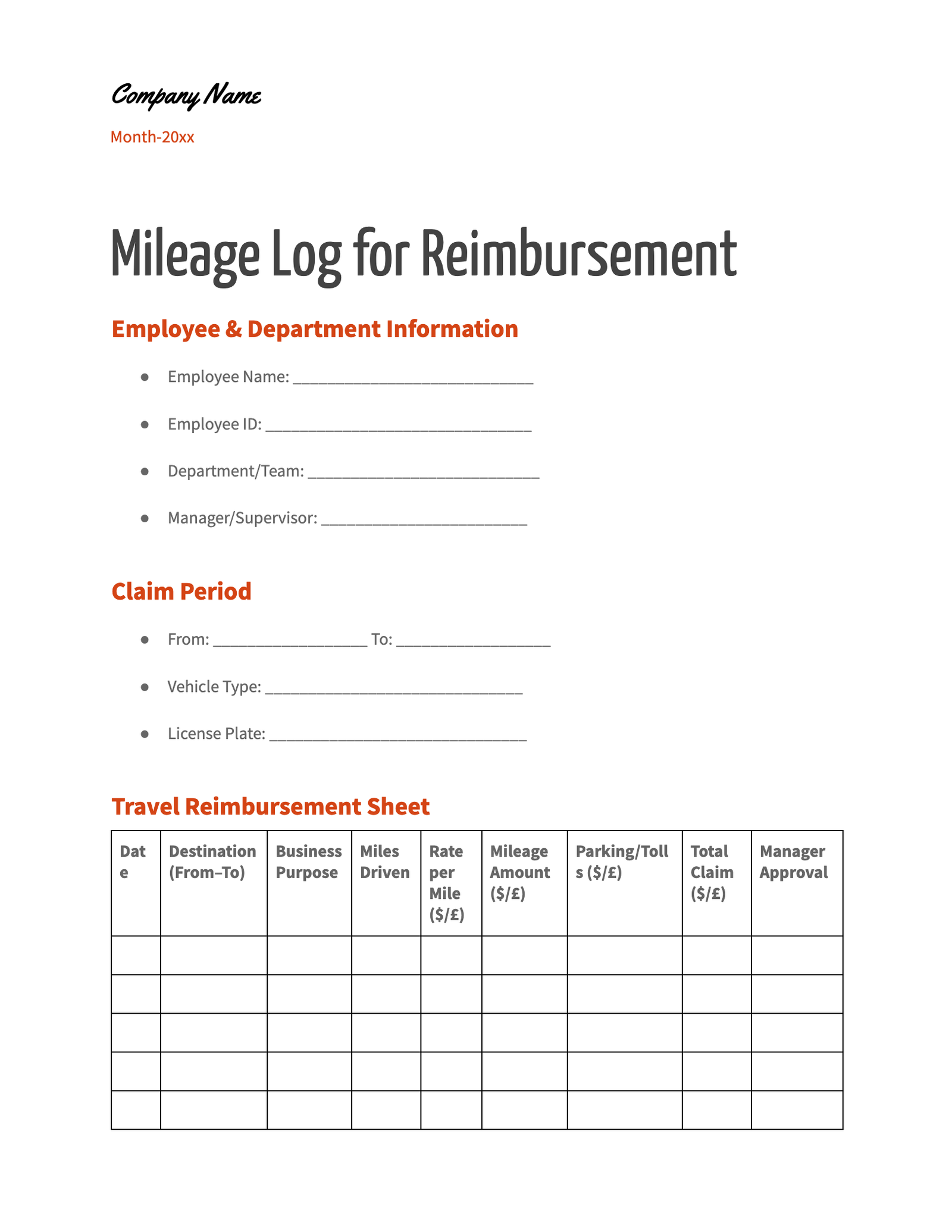

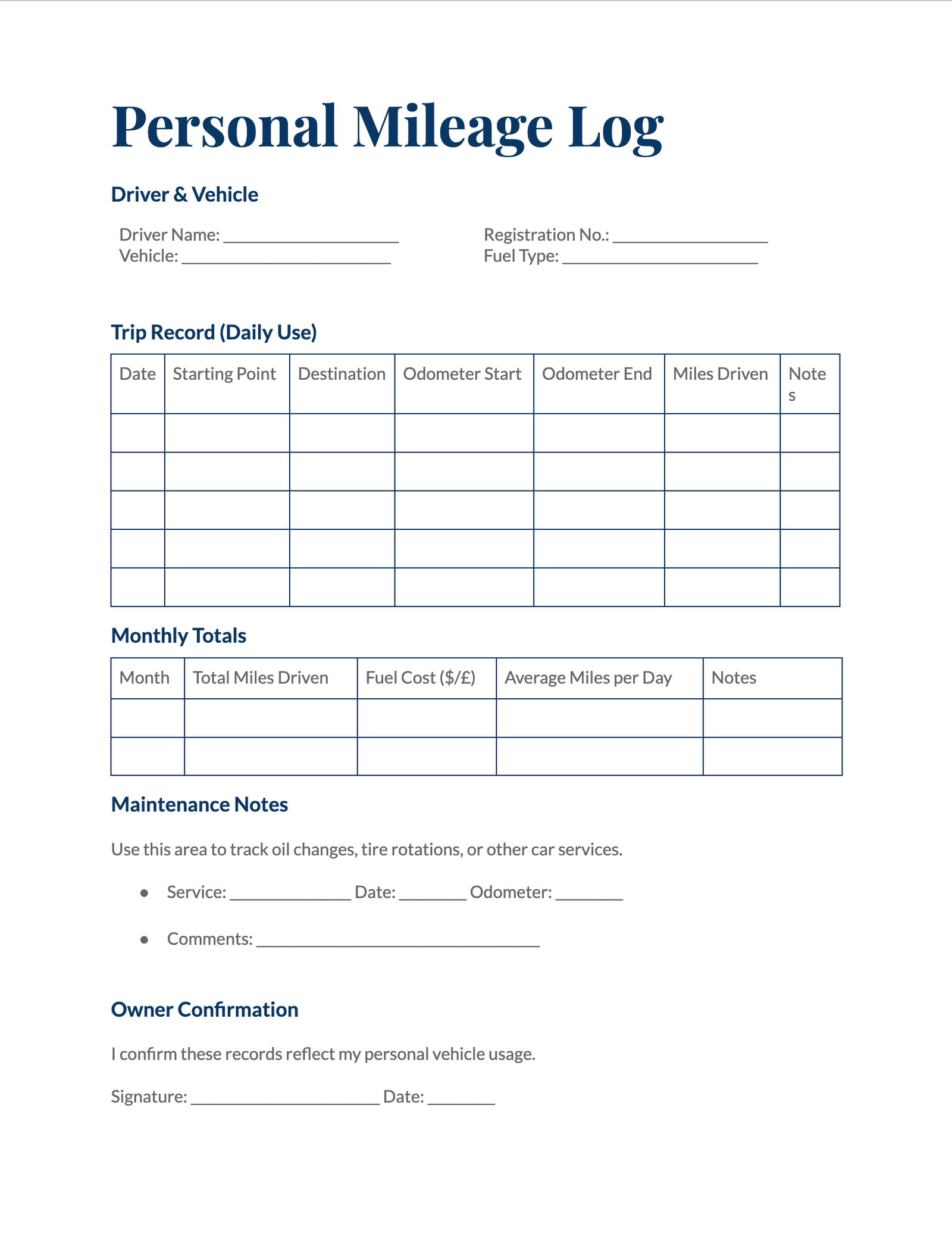

Mileage Log Format

Let’s find the step by step guide to create a Mileage Log in a simple format for professional record to track vehicle miles driven for work, business, or tax purposes.

Step by Step Guide to Create a Mileage Log

Step 1: Give a clear explanation of the purpose behind getting the Mileage Log.

Decide why you’re keeping the log:

- Business use like for tax deduction or reimbursement

- Personal tracking like to monitor fuel costs or usage

In both of the cases, the format will be the same but in general, the business mileage logs require more detailed information like client names or trip purposes.

Step 2: Choose a Format

You can keep your mileage log in:

- A notebook

- A spreadsheet

- A digital log app

Here’s a simple table format you can use anywhere.

Step 3: Include These Key Columns while writing a log

- Date

- Starting odometer

- Ending Odometer

- Total Miles

- Starting Location

- Ending Location

- Purpose of the Tip

- Notes (If any)

Step 4: Fill It Out

Whenever you go for a trip, maintain a clear record of the date that is given in the table columns like above so that you can keep a detailed track of each trip without missing.

Step 5: Calculate Totals

At the end of each week or month, calculate the miles by keeping your business miles and personal miles separate so that it can help you to get a record of those miles that need reimbursement or tax deductions.

Example of a Mileage Log:

| Date | Starting odometer | Ending Odometer | Total Miles | Starting Location | Ending Location | Purpose of the Tip | Notes (If any) |

| 2025-11-01 | 25,400 | 25,430 | 30 | Client X Road | Client C | Meeting | |

| 2025-11-02 | 25,430 | 25,455 | 25 | Client A | Head Office | Conference | Important meeting |

| 2025-11-03 | 25,455 | 25,475 | 20 | Personal | Medical Store | Personal | |

| 2025-11-04 | 25,475 | 25,490 | 15 | Client Z | Client Office Zene Road | Meeting |

Weekly Total:

- Business Miles: 30 + 25 + 15 = 70 miles

- Personal Miles: 20 miles

Step 6: Keep Supporting Documents to help you when needed

For business purposes:

A copy of this log either digital or printed

Receipts of fuel, maintenance and others

Appointment records to prove trip purpose

How to Write a Mileage Log?

While writing a mileage log, add the record date and then add the starting and ending readings of the odometer, mentioning the location details along with the purpose of each trip. Ensure to maintain consistent methods to record the information in a notebook, Excel spreadsheet, or any type of dedicated app. Maintaining the information this way will help to update content regularly and ensure accuracy.

Step-by-Step Guide:

- Date

Record the date of the trip that took place.

- Odometer readings

Ensure to monitor and record the readings of the odometer from the start and end of the trip.

- Purpose

Clearly mention the reason for the trip, for example, a client meeting, office supplies pickup, collecting office needs, and others.

- Starting and ending points

Note the address details, including the starting and ending points.

- Total mileage

Calculate the final mileage by subtracting the odometer readings at the starting point and the ending point.

- All other related expenses

Include all other expenses involved in your travel, such as tolls, parking fees, and others.

What is a mileage log?

A mileage log template is a ready-made document that typically calculates the company’s mileage-driven record of each vehicle, mainly for IRS audits and tax deductions.

What kinds of mileage are not deductible?

The commuting path that you generally follow to reach the destination and personal trips that are not related to your business are generally not deductible.

What kinds of mileage are tax-deductible?

Not all types of travel are deductible. If the trip is a business trip, medical travel, charitable work, or moving expense, then it is counted for deduction in the mileage log.

What are the types of mileage deductions?

Mileage deductions are generally calculated in two ways: the standard mileage method and the actual expense method. Apart from that, the mileage must be IRS-approved to be eligible for the deduction.

Does the IRS require odometer readings?

The present law does not mention anything about logging odometer readings except for the start and end-of-year readings and also when you start using a new vehicle. However, the employer may ask you to submit the detailed odometer readings for the trip.